Cloud-Native Consulting & Advisory

Design and implement cloud-native roadmaps for secure, compliant transformation.

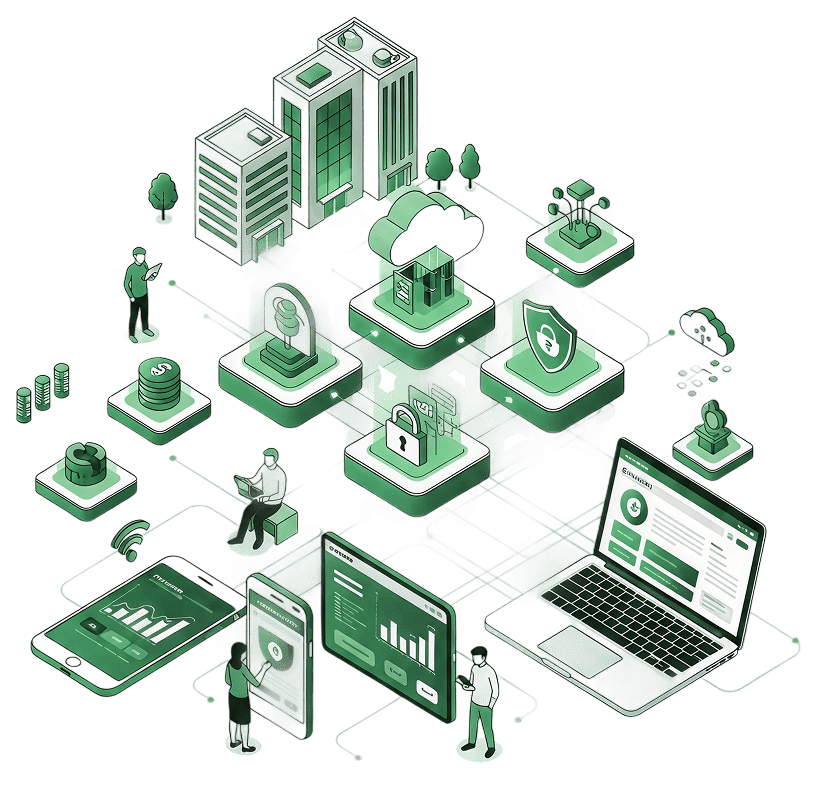

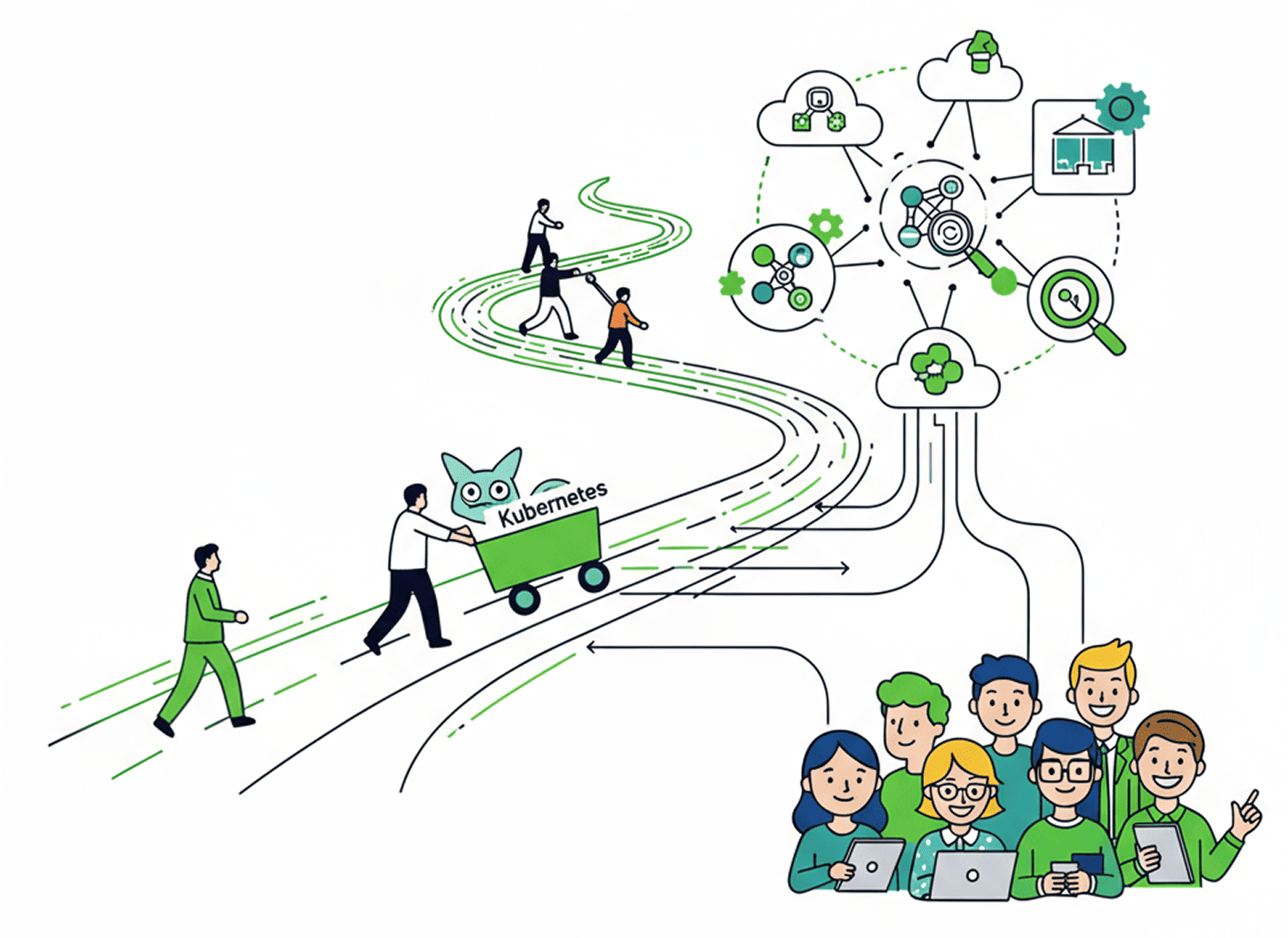

Accelerate digital transformation across FinTechs, NBFCs, and Banks with secure, compliant, and scalable cloud-native platforms. Modernize mission-critical financial systems with Kubernetes, microservices, and DevSecOps to stay agile, secure, and compliant. Many financial institutions hesitate to adopt modern cloud-native and microservices architectures, risking performance, scalability, and compliance gaps. Monolithic infrastructures hinder innovation and API integrations. Our cloud-native migration services enable faster releases and seamless third-party integrations. Adhering to GDPR, PCI-DSS, CCPA, and PSD2 is complex with outdated tech stacks. We help banks implement secure, policy-driven DevSecOps pipelines ensuring compliance continuity. Banks require 24/7 uptime and dynamic scalability during peak transactions. Kubernetes-based cloud-native infrastructure ensures elasticity and high availability. Real-time banking demands speed and reliability. Cloud-native observability tools like Prometheus and Grafana enable proactive monitoring and instant performance insights. Build a secure, scalable, and compliant financial ecosystem using Kubernetes, microservices, and modern DevSecOps frameworks. CBDC initiatives require scalable and secure platforms. AppsCode helps financial institutions implement cloud-native architectures for CBDC systems. Transform legacy banking systems into agile, customer-focused platforms powered by microservices and cloud-native technologies. Securely manage millions of transactions per second with scalable, event-driven architectures. Build intelligent analytics pipelines to detect anomalies, mitigate fraud, and optimize financial operations. Empower FinTech startups and ISVs to innovate faster with fully managed cloud-native environments. From strategy and migration to managed support, AppsCode empowers your financial organization to adopt cloud-native confidently. Our certified engineers bring expertise in Kubernetes, security, and regulatory compliance for financial-grade reliability. Design and implement cloud-native roadmaps for secure, compliant transformation. Refactor legacy banking applications into microservices deployed via Kubernetes. Extend your engineering team with AppsCode’s World-Class Kubernetes Expertise. Upskill teams with hands-on workshops on CI/CD, service mesh, observability, and security. Ensure 24/7 uptime and proactive issue resolution with our managed DevSecOps support. Implement Zero-Trust security, encryption, and data protection aligned with PCI-DSS, GDPR, and PSD2. AppsCode actively contributes to CNCF projects like Kubernetes, Prometheus, and KubeVault — helping financial organizations build on proven, open-source technologies. Explore how AppsCode can accelerate your digital transformation journey. Here are a few of the questions we get the most. If you don't see what's on your mind, contact us anytime. Our services help banking and finance organizations modernize their IT infrastructure and applications using cloud-native technologies. We cover application modernization, microservices adoption, secure cloud deployment, compliance, scalability, and continuous delivery for financial workloads. We leverage Kubernetes, Docker, microservices architecture, CI/CD pipelines, DevSecOps practices, cloud providers like AWS, Azure, GCP, and observability tools. Our approach ensures secure, resilient, and compliant financial applications in cloud environments. Yes — we work with your existing core banking, payment, and financial applications, modernize workloads, implement microservices patterns, and integrate cloud-native practices while ensuring regulatory compliance and security standards. Engagements typically start with a 1–2 week assessment of your infrastructure, applications, and compliance requirements. Implementation follows in 4–12 week phases depending on scope. We offer fixed-scope projects, time-and-materials consulting, or long-term advisory partnerships. Absolutely. Our solutions are designed for multi-cloud and hybrid deployments, ensuring secure, resilient, and compliant workloads across AWS, Azure, GCP, and on-premises financial systems. We enforce encryption, access controls, DevSecOps pipelines, automated compliance checks, monitoring, and disaster recovery. These measures ensure financial applications are secure, reliable, and compliant with industry standards like PCI DSS and GDPR. After implementation, we provide ongoing support, monitoring, optimization, and knowledge transfer. Our services ensure your financial applications remain secure, scalable, and optimized for continuous business growth. Pricing depends on infrastructure complexity, application scope, and ongoing support requirements. We offer fixed-scope projects, hourly consulting, and long-term retainers. Detailed proposals are provided after the assessment phase. Trusted by top engineers at the most ambitious companies InterSystems was delighted to engage with AppsCode in the delicate, yet fundamental task of supporting durable, non-ephemeral workloads with Kubernetes. We needed the best-prepared, most-proficient database operator consulting in the industry. Given AppsCode's pedigree of database building operators, the decision was easy. No time was wasted and all objectives reached in an amazingly short period of time. I would recommend AppsCode consulting for any Kubernetes related work. Voyager made it simple and efficient for us to protect and initiate our bare metal Kubernetes workload. Its underlying technology and extensive L4 support along with seamless SSL integration is what made us choose Voyager over others. Voyager team is also very responsive when it comes to support. Great product! Voyager is the easiest way to use the fast and reliable HAProxy as our ingress controller. At PriceHubble, it is the corner-stone of our blue/green deployments. I work with a few Kubernetes clusters and we use Voyager as our preferred ingress controller. We really like the ease of configuration. Documentation is pretty good. Also the use of HaProxy is important for us because it works really well with both L4 and L7 load balancing. One of our TCP services, Wayk Now, is able to withstand thousands of persistent connections very smoothly at the same time. We really like using Voyager. Its straightforward and well-documented config and SSL (especially Let's Encrypt) has made our migration of services to Kubernetes a breeze. Each major version has been a very welcome update! We're using Voyager as part of most Astarte deployments and it's orchestrated also by our brand new Operator. We are glad to showcase that.Cloud Native Solutions for the Banking & Finance Industry

Trusted by Global Banking & FinTech Leaders

Why Banking Needs Cloud-Native Transformation

$5.72M per incident – Average data breach cost in financial services

$14.8M – Average cost of non-compliant data policies

99% believe DevOps positively impacts their organization

49% achieve faster time-to-market after adopting DevOps

Top Challenges in Financial Cloud Transformation

Slow Delivery and Legacy Systems

Compliance & Regulatory Risks

Scaling & Resilience Challenges

Performance Bottlenecks

Cloud-Native DevOps Services for Banking & Finance

Central Bank Digital Currency (CBDC) Infrastructure

Retail & Corporate Banking Modernization

Cloud-Native Digital Payments

Analytics & Risk Intelligence

FinTech & ISV Enablement

Complete Cloud-Native Journey for Financial Enterprises

Cloud-Native Consulting & Advisory

Application Modernization

Team Augmentation

DevOps Coaching & Training

Enterprise Managed Support

Regulatory Compliance & Security

Proud Open Source Contributors

Ready to Adopt Cloud-Native Solutions?

Frequently Asked Questions

What do your Cloud Native Solutions for the Banking & Finance Industry include?

Which technologies and practices are used in cloud-native solutions for banking and finance?

Can you integrate cloud-native solutions with our existing banking systems?

What is the typical timeline and engagement model for cloud-native solutions in banking?

Do cloud-native solutions support multi-cloud or hybrid deployments for banking and finance?

How do you ensure security, compliance, and reliability in financial applications?

What happens after cloud-native solutions are implemented in banking and finance?

How much do cloud-native solutions for the banking and finance industry cost, and what are the pricing models?

What They Are Talking About us